1968, the library moved to a 4,000-square-foot building on Broadway and Dakin. The Hart Memorial Library is now the headquarters of the Osceola County Property Appraiser and is housed in a 43,000-square-foot building.

1968, the library moved to a 4,000-square-foot building on Broadway and Dakin. The Hart Memorial Library is now the headquarters of the Osceola County Property Appraiser and is housed in a 43,000-square-foot building.

Or

The first Poinciana store opened in 1988. It was a modular building and concurred with a collection of 14,000 books. This branch was moved to a more visible place, with a collection of 40,000 books and access to customers’ computers.

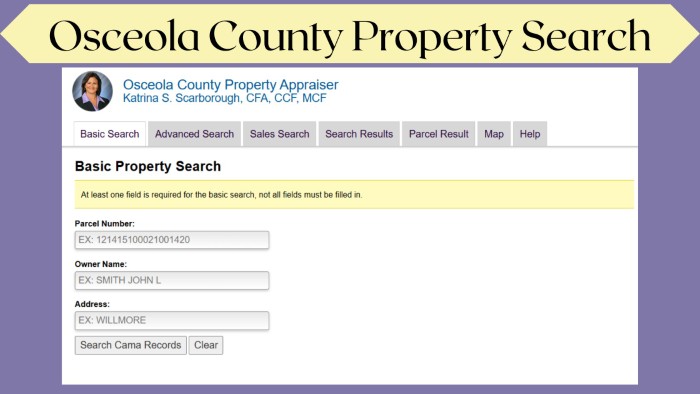

Steps to Follow for Osceola County Property Search

There are two ways to search for property in Osceola County Property Appraiser. The most used search option is basic search. For easy operation, Osceola County provides an ‘Advance Search’ option. Here, we will discuss the essential search guide. Follow some simple steps to search for property.

Step 1: Head to the browser and search for Osceola County Property Search or Visit www.property-appraiser.org.

Step 2: On the Osceola County website’s home page, you’ll see a search in the menu at the top right. Go to Search>>Property Search.

Step 3: The Oceola County Property Appraiser site will redirect you to the property search portal. Step 4: In the basic search section, enter your details, such as the parcel Number, Owner Name, and Address. Yes, you only need to fill out these details.

Step 4: In the basic search section, enter your details, such as the parcel Number, Owner Name, and Address. Yes, you only need to fill out these details.

Step 5: Just hit the button “Search Cama Records.”

You can search for property by following only these five steps. For more details and an advanced search guide, follow this Osceola County Property Search.

Know About Taxes, Land Records, and GIS

The Osceola Property Appraiser Registration Department handles the most diverse types of information and requests to the Osceola Property Appraiser Expert’s Office, including the creation of personalized maps, requests for information about client properties, allocation of lots, requests for division and merger, subdivisions, annexes, deeds, and easements (right of way).

Our department also prepares the necessary tax letter for land registration or co-ownership. For more information, see the subdivision certification process. If there is another way we can help you, please get in touch by phone, email, or in person. We are here to help.

Distribution of Taxes Levied

Section 195.052, Osceola County Florida Property Appraiser Statutes, as amended by the Florida Legislature of 2008, Chapter 2008-197, Florida Statutes, requires the Department of the Treasury and all Osceola County Property Appraiser real estate appraisers to publish certain tax information for city councils and counties on their websites(www.property-appraiser.org).

As a result of this law, the Department of the Treasury must publish specific information on non-voting Kissimmee Property Appraiser taxes for municipal and local governments on its websites(www.property-appraiser.org). In each Osceola County Property Appraiser, the following tables provide the following information for each privilege not voted on by Osceola County Property Appraiser and local governments:

The “Breakdown of Taxes Collected by Type of Osceola County Property Appraiser- Municipalities and Municipalities – The Fiscal Year 2020-2021” is in PDF format. This table shows the share of Osceola County Property Appraiser taxes paid by each county and the Osceola County Property Appraiser non-voting lien on each of the following types of Osceola Property Appraiser:

Residential real estate includes single-family homes, mobile homes, duplexes, three-family homes, multi-family lots, condominiums, and parcels of other real estate types, such as apartments.

- agricultural property, no family property, empty lots

- Non-residential real estate includes the following types, excluding parts used as residential buildings.

- Business improvement and vacancy

- Improved and free industry

- Institutional / Government

- Agriculture

- Other state leases, miscellaneous and non-agricultural areas

- tangible personal assets

- Central state-certified railway property

- Percentage of total taxes levied on new construction

Land Records and GIS Department

The Osceola Property Appraiser Registration Department handles the most diverse types of information and requests to the Osceola Property Appraiser Expert’s Office, including the creation of personalized maps, requests for information about client properties, allocation of lots, requests for division and merger, subdivisions, annexes, deeds, and easements (right of way).

Additionally, our department will prepare the necessary tax letter for land registration or co-ownership. For more information, see the subdivision certification process. If there is anything else we can do for you, please contact us by phone, email, or in person. We are here to help.

| Official Name | Osceola County Property Appraiser |

|---|---|

| Type | Portal |

| Use of Portal | Property Search |

| Language | English |

| Country | USA |

Learn About Farmland in Osceola County

Cattle

Livestock is the leading agricultural enterprise in the Osceola County Property Appraiser. Osceola County is Osceola County FL Property Search’s largest cattle-producing Osceola County Property Appraiser and ranks sixth nationally in beef production. A total of 580,258 acres are used for agriculture, of which 556,438 acres are for livestock. Osceola County Property Appraiser is also home to the largest ranch east of the Mississippi River. Deseret Ranch covers approximately 300,000 acres, including 184,400 in Osceola County Property Appraiser.

Citrine

Citrus also played an essential role in agriculture, with approximately 13,807 acres in the Osceola County Property Appraiser. As the state grew at the turn of the century, oranges became its farmers’ primary income source. Once again, the topography helped citrus. Citrus trees grow best in sandy, well-drained soil. The western part of the Osceola County Property Appraiser forms part of Lake Wales Ridge, which has mountainous and sandy soils ideal for citrus.

Information Technology Department

The Osceola County Property Appraiser Information Technology Division supports and manages the computer technology and resources used in producing the annual tax list, web applications, and geographic information system. (GIS) It provides products and services based on real estate and physical data used for creating and analyzing real estate listings to real estate Osceola Appraiser, commissioned sellers, and other public entities.

The IT department’s goal is to play an ongoing role in finding IT solutions to support the growth of the Osceola County Property Appraiser package base and scoring system. We update our system regularly, so your information and ownership changes may take up to 5 business days.

Agricultural Department

The Department of Agriculture is responsible for assessing all commercial farmland, large vacant lots, and government land for tax purposes. Florida law allows for the classification of farmland on a basis that farmland can support. Osceola County Property Appraiser Department validates farms to ensure they are eligible for the classification required by law. To qualify for classification, all properties are verified on-site (www.property-appraiser.org), and farm income and expense accounts are needed. These statements are compared with state averages in related fields to determine whether they support this operation. Rankings are a privilege and should not be abused. Agricultural classification categorizes different types of agricultural land, such as forests, grasslands, orchards, and nurseries. Land classified as agricultural is valued based on its agricultural value, often significantly lower than the market value, making it economically viable to continue this use.

Agricultural classification categorizes different types of agricultural land, such as forests, grasslands, orchards, and nurseries. Land classified as agricultural is valued based on its agricultural value, often significantly lower than the market value, making it economically viable to continue this use.

Residential Department

The Department of Housing evaluates all upgraded residential properties, including single-family homes, ten-unit buildings, condominiums, semi-detached houses, mobile homes, and vacant lots.

Each year, beginning January 1, each Kissimmee Property Appraiser is revalued to current market values as required by Chapter 193 of the Florida Statutes. Each Osceola Appraiser can be individually verified every five years to ensure the current building and Kissimmee Property Appraiser data are correct. A detailed review of area values in different district areas can also be done every few years. A search is also carried out in case of rips or tears or if the owner requests a search. These reviews sometimes result in significant adjustments to the current valuation due to changes in ownership and/or economics since the last full review.

Customer Service and Exemptions Department

Osceola County Property Appraiser’s customer service informs the public in a friendly, courteous, and competent manner by telephone, post, and email. The Homestead Waiver and many other waiver applications are made year-round by legal requirements.

Osceola County Property Appraiser Exemptions Department administers all exemptions: Foster Care, Widow, Widow, Disability Exemption, Limited Income Seniors, and Veterans Exemption. Our tax exemptions team creates and reviews new claims to confirm eligibility and help add additional tax exemptions for our eligible taxpayers. Osceola County Property Appraiser also has an investigation department investigating complaints of inappropriate exemptions.

About Osceola County

According to the 2020 US Census, 388,656 people, 109,642 families, and 81,168 families lived in the Osceola County Appraiser. The population density was 292 persons per square mile (139/km2). There were 162,661 house units at an average density of 122 per square mile (83/km2). Most Hispanics/Latinos in the Osceola County Appraiser are Puerto Ricans, representing approximately 33.7% of the population and the largest ancestry group in the Osceola County Property Appraiser.

38.2% of the district’s population belongs to a religious community. There are 206 or more orders in the district. 16.5% are Catholic, 1.3% Mormon, 3.5% Baptist, 3.7% Pentecostal, 1.4% Methodist, 8.3% belong to other Christian religions, 0.1% are Jewish, 0, 2% belong to an Eastern faith, and 3.2% are Muslims. There were 111,539 households; 57% were married living together, 23% had a head of household with no spouse present, 7% had a male head of household with no spouse present, and 13% were non-family members. The average size of households was 3.4 people per household.

There were 111,539 households; 57% were married living together, 23% had a head of household with no spouse present, 7% had a male head of household with no spouse present, and 13% were non-family members. The average size of households was 3.4 people per household.

In the canton, the population was distributed: 12% from 0 to 9 years old, 15% from 10 to 19 years old, 14% from 20 to 29 years old, 15% from 30 to 39 years old, and 13% from 40 to 39 years old. , 11% 50 to 19 years old, 59%, and 19% 60 years old or more. The mean age was 36 years. There were 97.20 men for every 100 women. For every 100 women aged 18 and over, there were 94.20 men.

The Osceola County Property Appraiser Search median household income was $52,279. The Osceola County Appraiser’s per capita income was $22,196. About 13.4% of the population lived below the poverty line, including 18.00% of those under 18 and 10.00% over 65.

FAQs

How is the application exam done?

The real estate appraisal team will determine eligibility. Additional information may be requested to help determine, such as B. IRS Schedule F, copy of city or Osceola County Property Appraiser Search business license, income and expense reports, or registration with the Commissioner of Agriculture. Before the order is processed, a review takes place.

What if the property is leased for agricultural purposes?

The same classification rules apply if the land is leased for agricultural purposes. The owner is responsible for ensuring the rental agreement complies with all agricultural classification laws. The landlord must submit a completed rental agreement with the application.

What if there is land on the property?

If a house is on the Kissimmee Property Appraiser, the surrounding land and outbuildings are not eligible for agricultural classification. As long as the Osceola County Property Appraiser is the owner’s primary residence, you can claim a homestead exemption for that Osceola County Property Appraiser.

Conclusion

Three elected groups govern the Osceola County Property Appraiser government, each independently leading separate branches. These include the five-member district commission, five separate constitutional officers, and several court officers. The Osceola County Property Appraiser Search Commission is responsible for funding the budgets of all Osceola County Property Appraiser governments, including independently elected constitutional and judicial officers and the commission’s departments. Each Independent Agent may, in its sole discretion, administer its programs. The district committee exercises control only over its departments.